Understanding Mini Bulldozer Costs and Financing Options

Introduction to Mini Bulldozer Financing

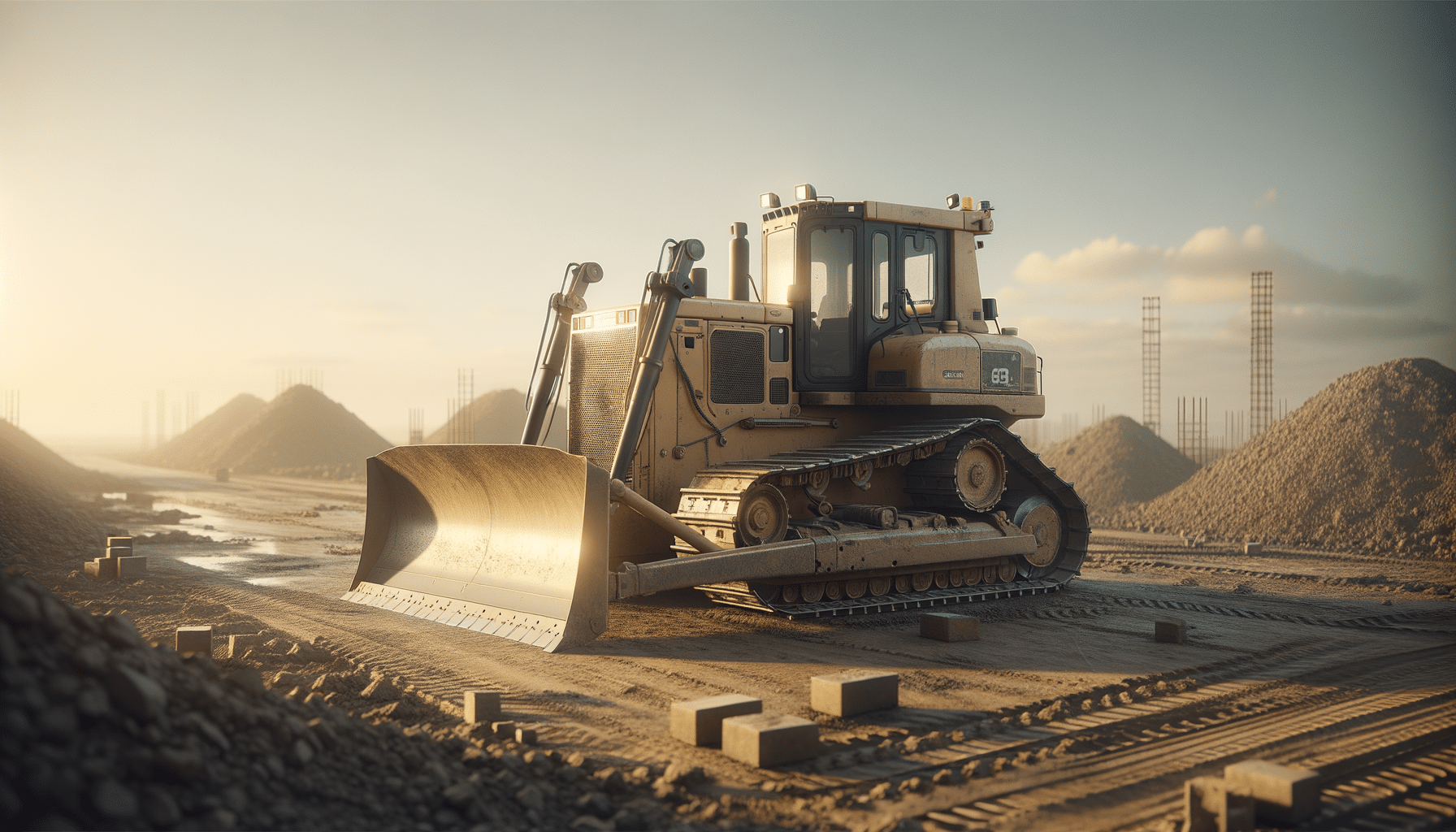

In the world of construction and landscaping, the mini bulldozer stands out as a versatile and indispensable piece of equipment. Its compact size and powerful capabilities make it ideal for a variety of tasks, from grading and excavation to demolition and site preparation. However, the cost of acquiring a mini bulldozer can be substantial, prompting many businesses and individuals to explore financing options. Financing a mini bulldozer involves understanding various aspects such as loans, leases, and payment plans, which can be tailored to meet specific financial needs. This article delves into the nuances of mini bulldozer financing, offering insights into how to effectively manage equipment costs.

Types of Financing Options Available

When considering financing for a mini bulldozer, several options are available, each with distinct advantages and considerations. Understanding these options is crucial for making informed decisions:

- Equipment Loans: A common choice, equipment loans allow you to purchase the mini bulldozer outright while spreading the cost over a series of monthly payments. Interest rates and loan terms can vary, so it’s essential to shop around for competitive offers.

- Leasing: Leasing offers flexibility, allowing you to use the equipment for a set period without the responsibility of ownership. At the end of the lease term, you might have the option to purchase the mini bulldozer at a predetermined price.

- Rent-to-Own: This option combines elements of renting and purchasing, where payments contribute towards ownership. It’s a viable path for those who wish to eventually own the equipment but prefer to start with lower upfront costs.

Each financing option has its own set of terms and conditions, influencing the overall cost and financial commitment involved. It’s advisable to consult with financial advisors or equipment dealers to determine the most suitable option based on your budget and long-term goals.

Factors Influencing Financing Terms

Several factors can impact the terms and conditions of mini bulldozer financing. These factors include:

- Down Payment: The size of the down payment can significantly influence the financing terms. A larger down payment may result in lower monthly payments and reduced overall interest costs.

- Interest Rates: Interest rates are a critical component of financing agreements. Rates can vary based on market conditions, creditworthiness, and the lender’s policies. It’s important to secure the most favorable rate possible.

- Credit Score: A strong credit score can enhance your chances of securing better financing terms. Lenders often assess creditworthiness to determine risk and set interest rates accordingly.

- Equipment Condition: New versus used equipment can affect financing options. New mini bulldozers may have different financing terms compared to pre-owned ones, impacting the overall cost.

Understanding these factors can help in negotiating better financing deals and planning for the financial commitment associated with acquiring a mini bulldozer.

Comparing Costs and Benefits

When deciding on financing a mini bulldozer, it’s essential to weigh the costs against the benefits. Here are some aspects to consider:

- Cost of Ownership: Owning a mini bulldozer involves not just the purchase price but also maintenance, insurance, and potential repairs. Financing can help manage these costs by spreading them over time.

- Operational Efficiency: A mini bulldozer can enhance productivity and operational efficiency, potentially leading to increased revenue. The benefits of improved efficiency can offset financing costs over time.

- Tax Implications: Certain financing options may offer tax benefits, such as deductions for interest payments or depreciation. Consulting with a tax advisor can provide clarity on potential savings.

By carefully evaluating these factors, businesses and individuals can make informed decisions that align with their financial capabilities and operational needs.

Conclusion: Making the Right Choice

Financing a mini bulldozer is a significant decision that requires careful consideration of various factors, including financing options, terms, and long-term benefits. By understanding the different avenues available and assessing your financial situation, you can select a financing plan that suits your needs. Whether opting for an equipment loan, lease, or rent-to-own agreement, the key is to balance costs with the operational advantages that a mini bulldozer can provide. As with any financial decision, thorough research and professional advice can lead to a successful acquisition, empowering your business with the tools needed for growth and efficiency.